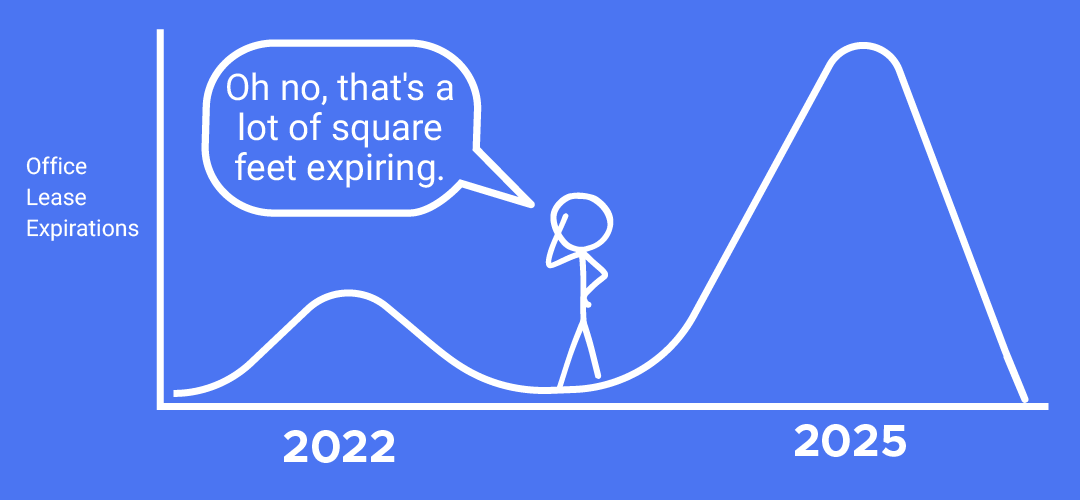

In 2022, leases on a record 243 million square feet of office space across the U.S. will expire(3). That’s 11% of the total office space in the U.S.

And that’s not all.

By the end of 2025, 900 million square feet will expire (7).

Businesses aren’t exactly clamoring to fill all that available space. In fact, 52% of businesses plan to reduce office space over the next three years(8).

So, how can owners adapt to this new world? With shorter term leases that offer their tenants – and themselves – the flexibility to stay agile. If your tenants have leases that are expiring in the next few years, they may be more likely to stay put if offered a shorter lease. And if they still want to vacate the space, offering it up as flex space to new businesses makes it much more attractive.

Nearly 70% of large companies listed flex space as a top amenity they seek in a build, with 56% already using it and 43% saying they foresee a need for it in the future(6).

This need for agility has been driving demand for shorter and shorter leases. In 2021, more than 30% of new leases were less than one year. (4)

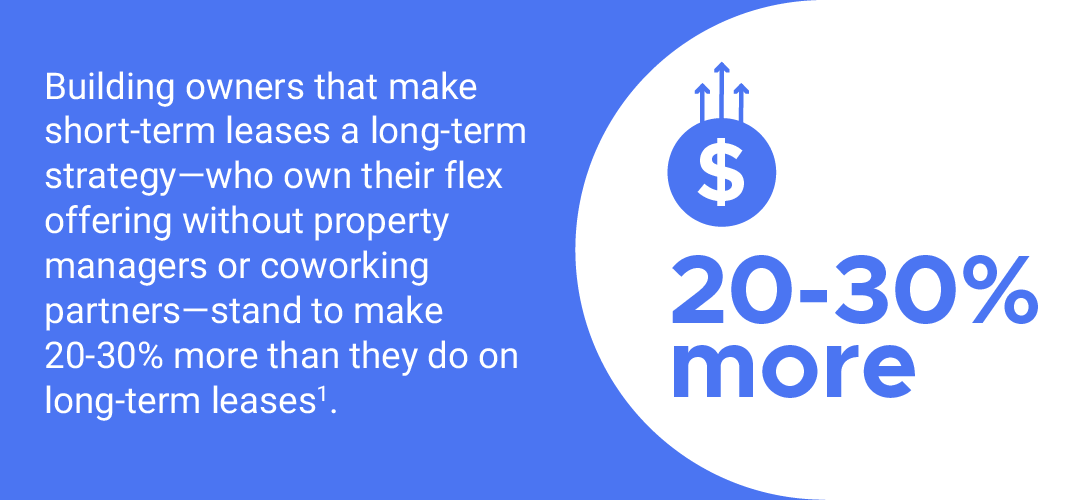

With office vacancy rates already hovering at 18%, building owners can’t afford not to adapt to the market. But incorporating flex space isn’t just about surviving, flex space is a powerful tool that can help owners thrive. Not only does it offer a way to fill space quickly and build new relationships, owners can also earn a premium of up to 20-30% off long-term leases(1).

Owners who make short-term leases part of a long-term strategy and truly own their flex offering – without paying out the nose for property managers or coworking partners – are well positioned to ride out the coming “vacancy tsunami” and, dare we say, perhaps even enjoy smooth sailing in the years ahead.

LaCoure, Robert. “The Future of Coworking Spaces and Landlords.” Lee & Associates. November 4, 2019. https://www.lee-associates.com/houston/2019/11/04/the-future-of-coworking-spacesand-landlords/

Chen, Lu. “Q1 2022 Preliminary Trend Announcement.” Moody’s Analytics. April 04, 2022. https://cre.moodysanalytics.com/insights/cre-trends/q1-2022-preliminary-trend-announcement/

Putzier, Konrad and Peter Grant. “Record High Office Lease Expirations Pose New Threat to Landlords and Banks.” The Wall Street Journal. April 12, 2022. Record High Office Lease Expirations Pose New Threat to Landlords and Banks – WSJ

Fagan, Kevin and Xiaodi Li. “Q4 2021: Office First Glance.” Moody’s Analytics. January 15, 2022. https://ma.moodys.com/rs/961-KCJ-308/images/4Q%202021%20Office%20First%20Glance-nd.pdf

Jones Lang LaSalle. “The Future of Flex.” December 06, 2021.https://www.us.jll.com/en/trendsand-insights/research/the-future-of-flex